We create value for you…

Our firm is composed of senior only professionals who have seen it all over their extensive careers. Our value proposition centers around a pragmatic approach to serving the needs of the private capital world.

About UsOur firm is composed of senior only professionals who have seen it all over their extensive careers. Our value proposition centers around a pragmatic approach to serving the needs of the private capital world.

About Us

We not only perform comprehensive analysis and provide strategic recommendations, but also have the ability to assist in execution. Learn more

“Kirchner’s work was characteristically excellent, insightful, and very helpful to us as we assess which next steps to take with one of our portfolio companies.” – PE Investor

We provide a full spectrum of operational support offerings including operational strategies, workout/turnarounds, restructurings, and interim management to companies and their investors. We are especially adept at salvaging and enhancing value in distressed situations. Learn more

“Kirchner was able to step into a complicated situation and develop a comprehensive, practical ‘Turnaround’ plan.” – PE Investor

We specialize in advising small and mid-market companies on sell side mandates to strategic buyers including those centering around deep intellectual property. Learn more

“Together with Kirchner, we were able to convey the strategic value MDT will bring to the combined entity and as a result, more than doubled our valuation.” – CEO

We have developed proprietary processes and models from an operational perspective for evaluation, value creation, and reporting on portfolios and companies with a focus on complete transparency and understanding. Learn more

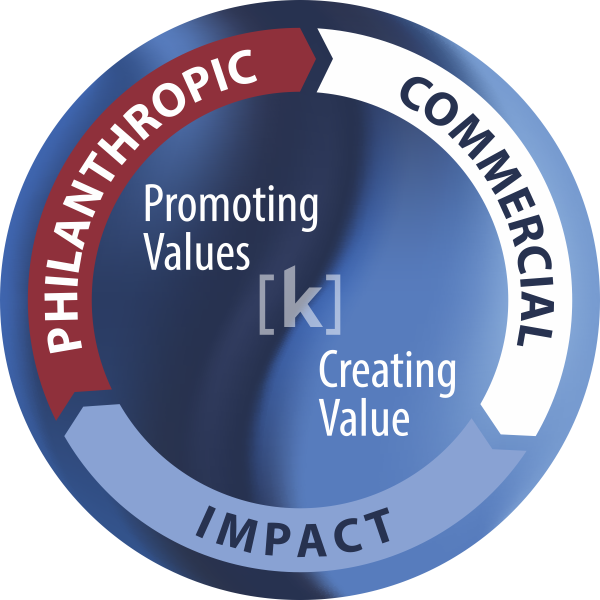

We pioneered proprietary models to help traditional and impact investors and their LP’s enhance value creation and bring necessary resources to ensure success. The initiative helps limited partners and advisory committees to realign interests and help optimize returns. Learn more

Kirchner Group is active in four aspects of asset management, Fund Formation, Fund Management, Fund Advisory and management of strategic spin-outs. We manage assets for some of the largest insurance companies, commercial banks and institutional investors in the world. Learn more

Our unprecedented 30 year track record of “earning and

returning” represents the backbone of what is today

considered financial-first impact businesses and investing. As pioneers in impact, we have worked with hundreds of companies, investors and portfolio managers from around the world to realize impact and financial returns –enhancing value and values. Learn More

“We do not inherit the earth from our ancestors, we borrow it from our children.” – Native American proverb